Evaluate Your Startup Like an Investor

A good investor knows what a good business looks like. And so should you.

👋 Hi, I’m Christo. Welcome to this week’s edition of the Growth Receipts Explainer series. In this series I attempt to bring clarity to the most important startup concepts. As always, my hope is that you find some value to take back to your own business.

For many startups, funding is the gateway between growing and not.

That would make venture capitalists (VCs) the gatekeepers of growth.

But why are they the ones holding the keys?

What arcane knowledge do they possess that decides the fate of startups like yours?

What are they actually looking for?

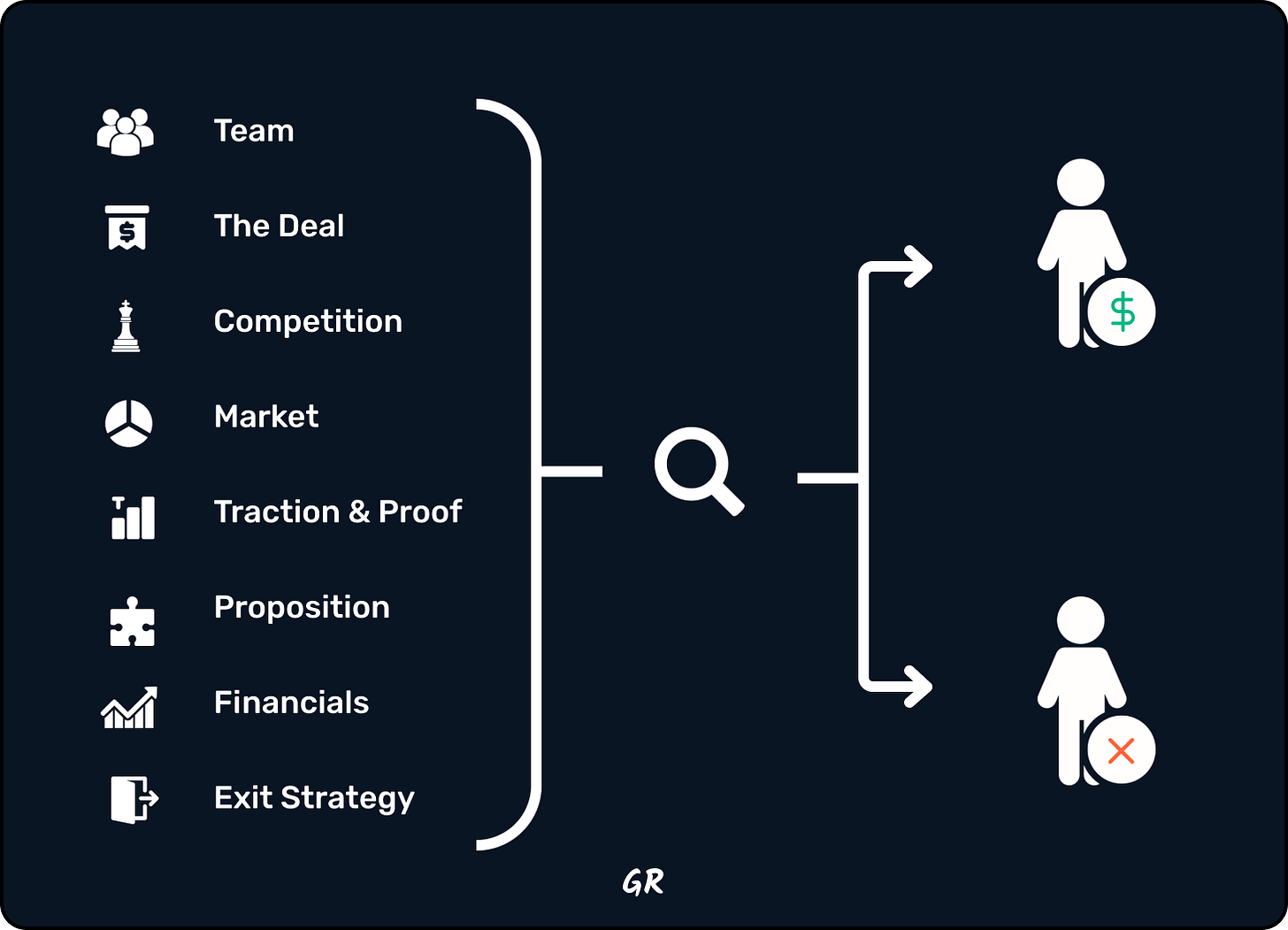

Well, they’re looking for answers to a very specific set of questions.

The answers to these questions will guide them to their main question; can you and your startup turn their money into more money.

From the countless investor pitches that I’ve sat in and reviewing VC meetings from some of the most successful startups in the world, I believe that list contains 8 main questions.

The answers to these 8 questions reflect the health, potential, and resilience of your business.

In this post, I’m going to break down these eight fundamental questions and some of the underlying reasons these questions are relevant.

For each question I’ll dive a little deeper into specifics and give some examples of:

Answers that may send positive signals to an investor (🟢)

Answers that may raise eyebrows that you should be aware of (🟠)

Answers that you should be ready to address/improve (🔴)

Why?

Because the better you understand the answers to these questions for yourself, the better you will be able to fine-tune each area of your business to create an unstoppable enterprise.

Ok, let's go!

1. Who are you and who is your team?

You will often hear VCs say that they don’t invest in a company, they invest in the founder(s).

This is true, and the earlier the startup the more true it is.

They want to know if you are the right team for the job. The ‘job’ being to turn their money into more money.

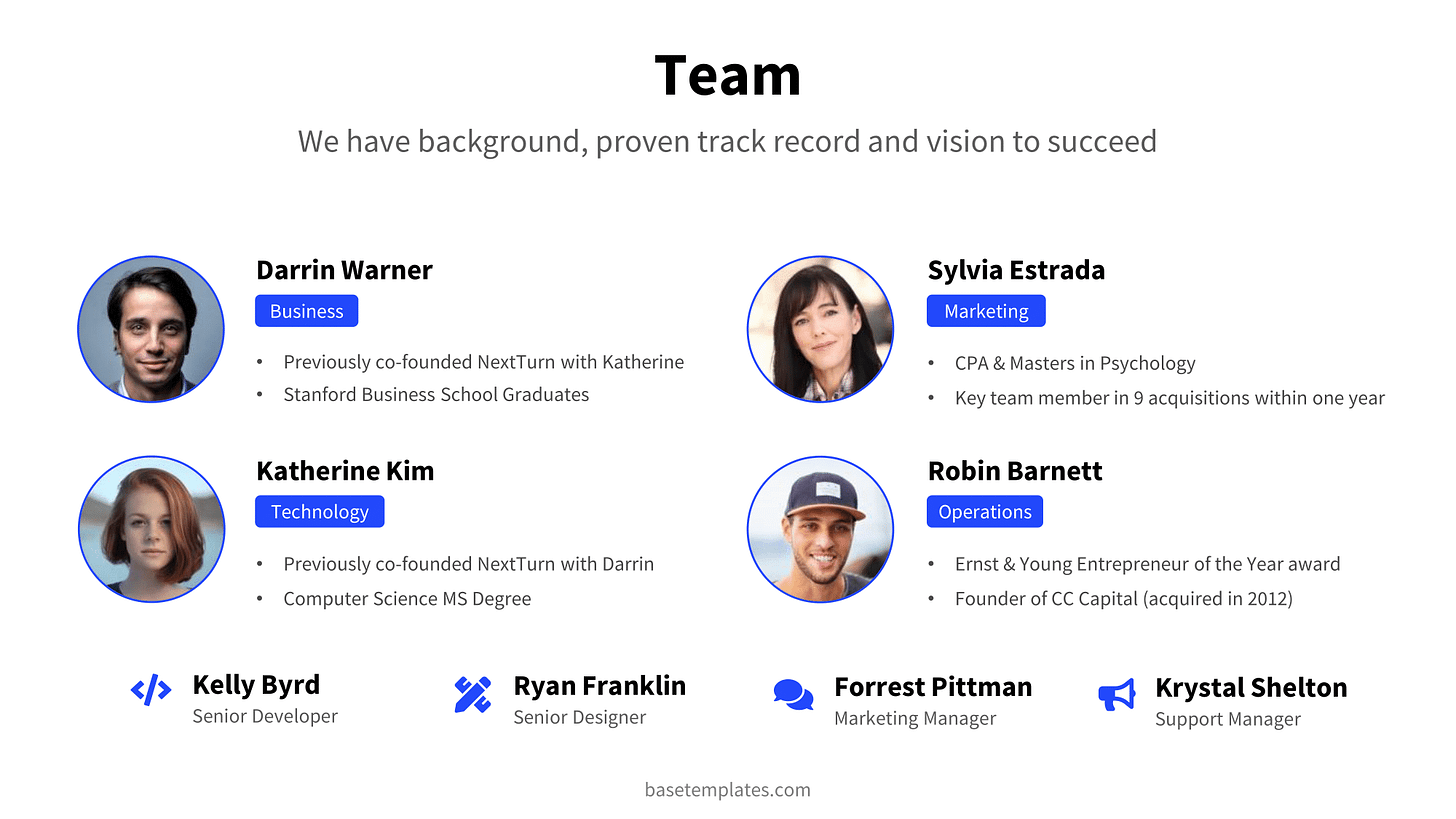

In a pitch deck, these answers are often hinted at on the Team slide.

Example team slide from an investor deck. [source]

Diving further into this question, they want to understand the following:

What’s your attitude and are you passionate?

Startup life is HARD (yes, all-caps-difficult) and it’s important that the founders are dedicated to see the vision through when the road gets rocky.

Are you going to be able to lead a team and be the beacon of light they need to guide them?

🟢 - You and the founding team have genuine enthusiasm for the product and vision.

🟠 - You clearly have passion but perhaps lack of direction.

🔴 - You convey a lack of conviction or superficial interest in the product.

Do you have any relevant, transferable experience?

The line between making it and not in business is very fine, especially early on.

VCs want to know that there is someone at the helm of your startup that has done this before.

And if you haven’t done it before, that you at least understand the industry really well.

🟢 - You have previously succeeded and have deep industry knowledge.

🟠 - You have a mixed track record and fairly general, surface level industry experience.

🔴 - You have failed at multiple startups and no prior connection to the market.

Note: Failing at a previous venture is not a automatic disqualification. In fact, for many investors this is seen as a tick in the 'pros' column. What’s your education and qualification background?

An ivy league education is not a ‘must have’ for the founding team.

However, in most cases investors want to know that the team has the educational prowess that make them the best team to take on the challenges ahead.

🟢 - There are complimentary skills within the team.

🟠 - There are some gaps but these are mainly in easily learned areas.

🔴 - There are major skill gaps in the leading team that could hinder progress.

How many founders does your startup have?

How your answers here are perceived will very much depend on the rest of the answers for this section.

The investor wants to see that everyone that is here, needs to be here. As a general rule, 2 to 3 founding members is optimal.

Does everyone have a critical role to play or are the ‘too many cooks in the kitchen’?

When there are too many founders in a startup, conflicts can occur when it comes to things like equity sharing, decision making, value and vision alignment and clear role definitions.

On the flip side, if there are not enough founders there can be big gaps in the required skillset of the team.

🟢 - You are a balanced team with diverse, complimentary skill sets.

🟠 - There is potential for conflicts but nothing that can’t be worked through.

🔴 - You’re either a solo founder or too many founders causing potential conflicts.

Who is advising you and what do they bring to the table?

For everything the founding team is not, there’s advisors.

Ideally at least.

Advisors and NEDs (non-executive directors) are independent players who provide advise and guidance to you and your team.

In many cases, these are experts in the industry and may even be your ‘foot in the door’ as a network lever.

As with the team questions, investors will want to see that advisors bring specific benefit to the team and overall mission.

🟢 - You have a team of experienced advisors who provide guidance and mentorship.

🟠 - There are some advisors available to you but in a very limited arrangement.

🔴 - You lack certain expertise in your team and there is no mentorship or guidance available to you.

2. What investment deal are you offering?

While sitting in a pitch meeting, some investors may seem more engaged than other.

You can rest assured though, not a single investor will ever miss the answer to this question.

When it boils down to it, this is why investors do what they do.

The deal. Investment terms and valuations.

Example deal or ask slide from a investor deck. [source]

To understand the details of the deal, there are a few things they are going to want to know:

What equity are you offering and at what valuation?

The amount of money you are raising and the equity you are offering for that amount will give the investor an immediate answer as to what you think your business is worth.

For early stage startups, this is the realm of fairy dust and crystal balls.

What is your company worth and how do you know this to be true?

🟢 - You have set a realistic valuation on your business with great growth potential.

🟠 - You have set a slightly aggressive valuation but it’s better to be optimistic.

🔴 - You have overvalued your business with unjustifiable financial projections that seem highly unlikely to be reached.

What are the terms of your investment deal?

You could be offering 80% of your company for a fair price but if the deal is too complicated or favors one side too much, there might still not be any interest.

There are endless ways that a deal can be skewed.

The most common of these often involve restrictive covenants, unfavorable liquidation preferences, punitive anti-dilution provisions, excessive board control, and overly restrictive exclusivity clauses.

In the event that you are lucky enough to have an investment deal on the table, it is very much advised that you use lawyers.

In a perfect world, both parties should be eager to sign on the dotted line.

🟢 - You are negotiating fair terms that protect both parties.

🟠 - The terms of deal seem overly complex but are negotiable.

🔴 - The terms are very complex and have clearly been set to favor one side only.

How much money are you looking to raise?

It’s safe to assume that right after this question you will also hear ‘and what will you do with the money’

Investors are rarely too focused on the exact amount.

What they are looking for, however, is what you are going to spend that money on and what the return to the business growth will be.

As a general rule of thumb your funding should last you at least 18 months.

🟢 - You are looking to raise the right amount for sustainable growth.

🟠 - Slightly over/under the required amount.

🔴 - You are asking for too little or too much money without clear justification.

If you are looking for a term sheet template, I created one here.

3. Who are your competitors and why can’t you be copied?

Any founder that says they don’t have any competition probably hasn’t done a Google search.

Investors know this.

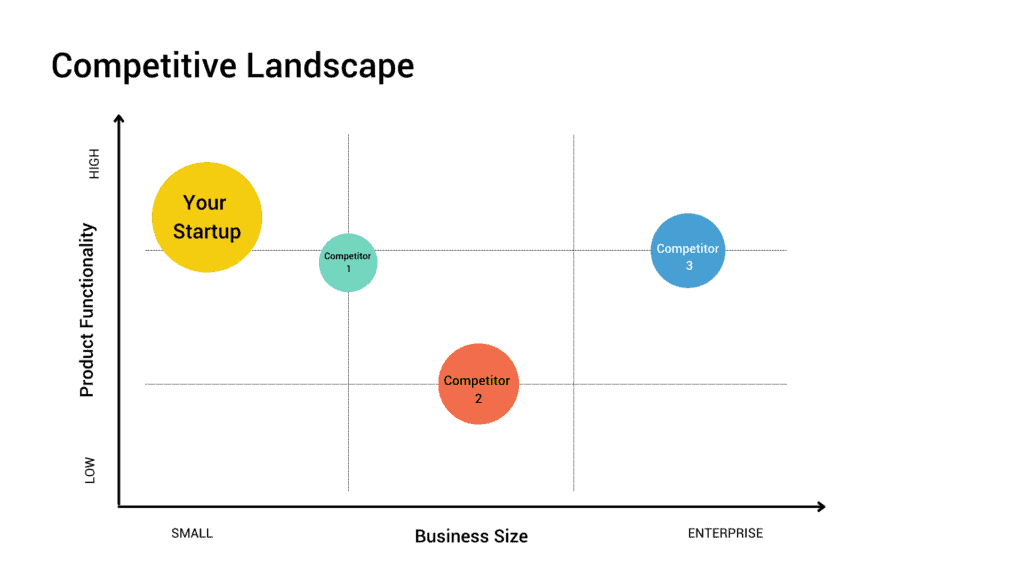

What they care about is that you understand who you are competing against, what they are better at and what things you have that’s going to make it hard to eat your lunch.

Example high level competitive comparison slide from investor deck. [source]

Do you have patents or other protection?

Having patents and intellectual property protection is not going to stop anyone from copying you.

But it is going to make it really inconvenient and expensive for them.

It’s a nice brick wall in front of your palace.

🟢 - You have intellectual property protection

🟠 - You have pending patents or are in talks with patent lawyers.

🔴 - There are known companies working on competing products and there is nothing in their way.

What are your competitors’ strengths and weaknesses?

Not having any competitors is almost impossible.

Knowing exactly what your competitors do well and not, is a must.

This is not only good for those investor meetings but everyone in your team should understand what you’re up against.

🟢 - You have a comprehensive understanding of competitors.

🟠 - You have some understanding, but a quick search highlights some room for deeper analysis.

🔴 - You show to have ignored or dismissed any and all competition.

4. How big is your market and how much of it can you capture?

Investors want to know if you’re going to be the big fish in a small pond or a minnow in the ocean.

Neither is right or wrong.

But the answer will show your potential. And every investment is an investment into potential.

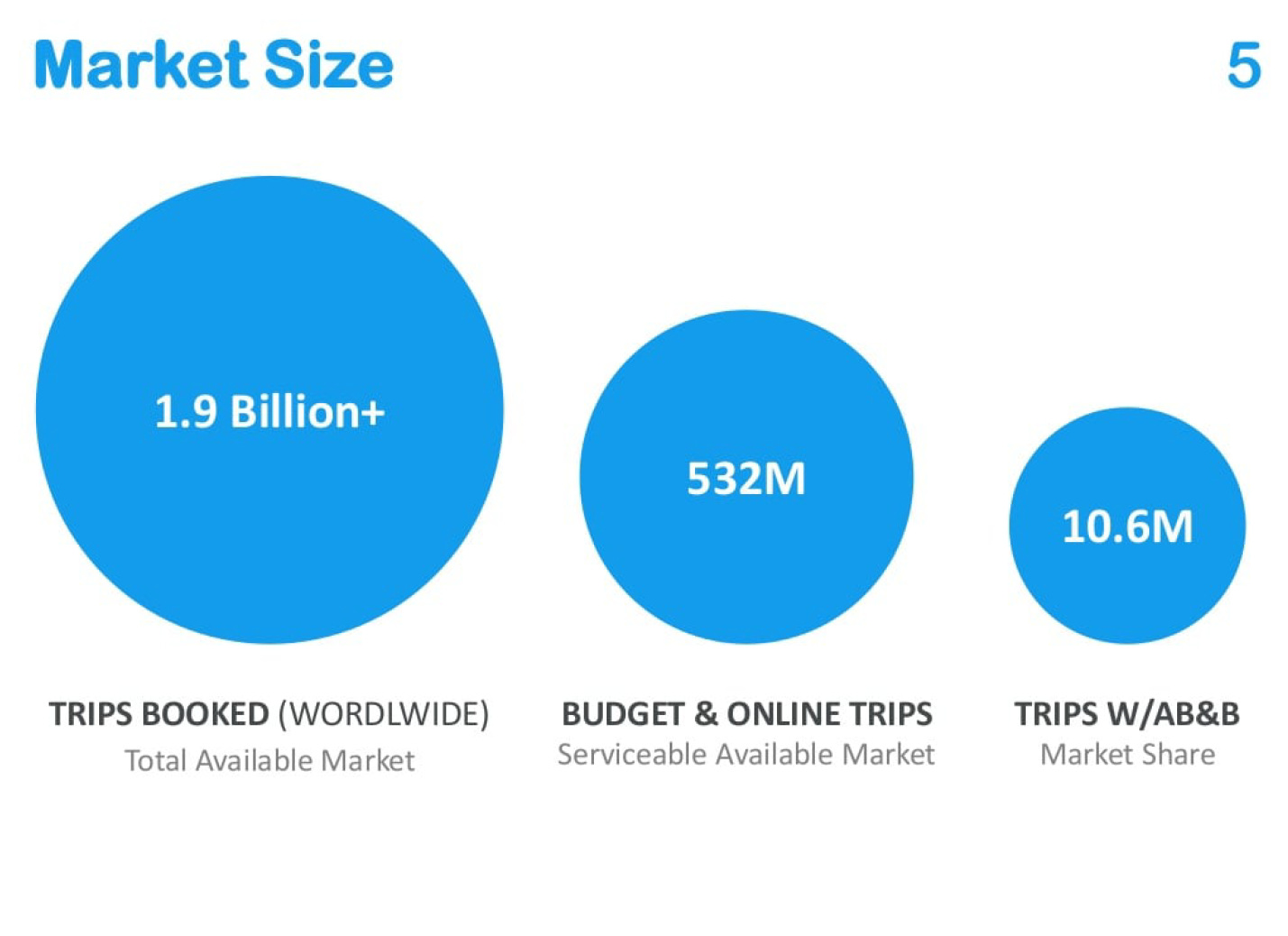

A reimagined design of the original Airbnb market size investor deck slide. [source]

What’s your TAM, SAM and SOM?

This is a slide on every investor deck and it’s used to answer the question about size and capture of the market that you’re in.

This post does a good job of explaining these 9 letters if you’re eager to learn more.

🟢 - You have a clear understanding of market size, opportunity it presents you and your piece of the pie.

🟠 - You have a general understanding but the numbers needs refinement or don’t quite make sense.

🔴 - Your numbers are unrealistic or vague and it doesn’t seem likely you will capture that much or little of the market.

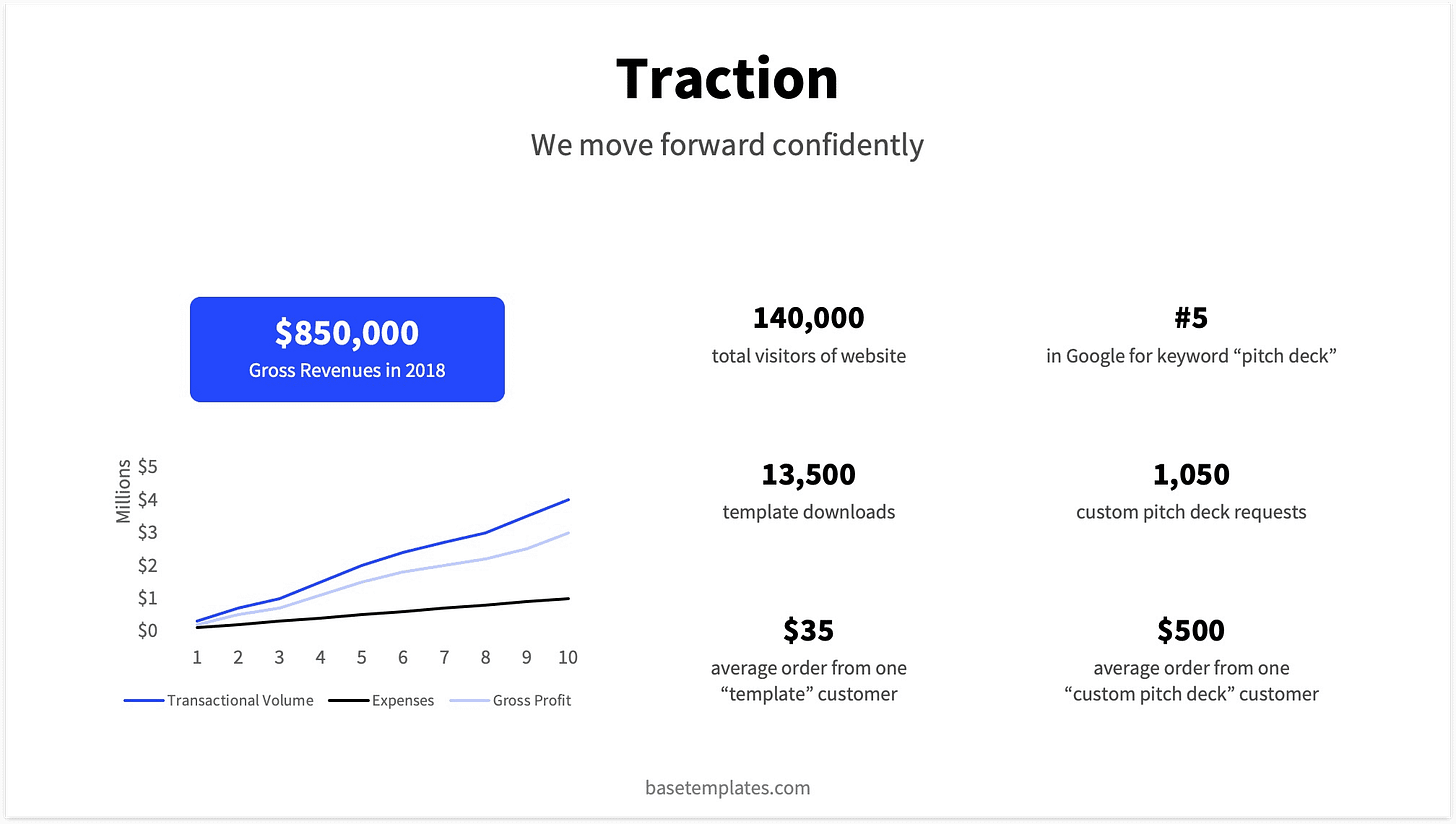

5. What traction do you have and what’s your proof?

There is no better proof of a good product than the raving testimonials of happy customers.

There is also nothing that raises doubt faster than saying you have none.

For this reason, investors will put a lot of weight into these answers.

And if you don’t have customers, the next question will be how close are you to getting customers?

Example traction slide from an investor deck. [source]

How many paying customers do you have?

The only thing harder than getting customers is getting and keeping paying customers.

A customer parting ways with their hard earned dollars is the ultimate validation that you’ve built something good.

🟢 - You have a growing customer base with low churn.

🟠 - Your customer base is growing slowly but stable.

🔴 - You customer uptake seems to have plateaued or you are not able to retain customers (high churn).

How many beta users do you have and what was their feedback?

Beta users is a sure way to get feedback and make your product better.

Investors want to see that you have been working closely with your target market and that you have been implementing their feedback.

If you have done this well it’s a sign that you have found the ever wondrous product-market fit.

🟢 - You have validated product-market fit.

🟠 - You got some beta users but very few stuck around.

🔴 - You don’t have beta users or have unsuccessfully implemented their feedback.

Do you have a MVP?

If you’re too early for a beta roll-out or paying customers the next best thing is knowing what product will get you to that point.

Your minimum viable product (MVP) is the most barebones thing you can release that will provide value to early users.

Having this fleshed out means you understand user needs and understand the importance of getting to market quickly.

🟢 - You have a tangible product ready for the market.

🟠 - Your MVP is in progress but not quite there yet.

🔴 - You lack a clear product vision or MVP.

6. What makes your startup unique?

"You do not merely want to be considered just the best of the best. You want to be considered the only ones who do what you do." - Jerry Garcia

Understanding what makes you unique is going to play a huge make-or-break role in your startup’s success.

It’s going to be the reason you do or don’t scale. The reason you can or can’t take market share and the reason you do or don’t survive changing market conditions.

Investors will want to know how you’re unique as it relates to three primary sub-questions.

Example value proposition investor deck slide. [source]

How do you plan to scale?

How you plan to grow is as important to an investor as it should be to any founder.

In order to grow, you need to have a plan and the means to do so.

🟢 - You have demonstrated the ability to scale.

🟠 - Your business has the potential to scale but this is not yet proven.

🔴 - You have achieved limited scalability with an unclear plan.

What is your competitive advantage?

As we discussed earlier, a competitive advantage is going to speak to your customers (new and existing), through every channel you have.

For investors a good solid competitive advantage means you can convert customers and you can maintain a moat of defensibility around your business.

🟢 - Your business and product has a unique competitive advantage.

🟠 - You may have an advantage but it’s not fully proven.

🔴 - It won’t take much for a competitor to replicate your biggest features.

Can you earn revenue and keep earning revenue?

At some point, every business is going to hit a revenue and/or user uptake plateau.

To get out of the plateau you’re going to need to adapt and innovate.

Innovate what you sell (product), how you sell (business model) and to who you sell (target audience).

🟢 - You can show long-term profitability potential.

🟠 - Profitability is perhaps there but it’s uncertain.

🔴 - There is a lack of clear future revenue streams.

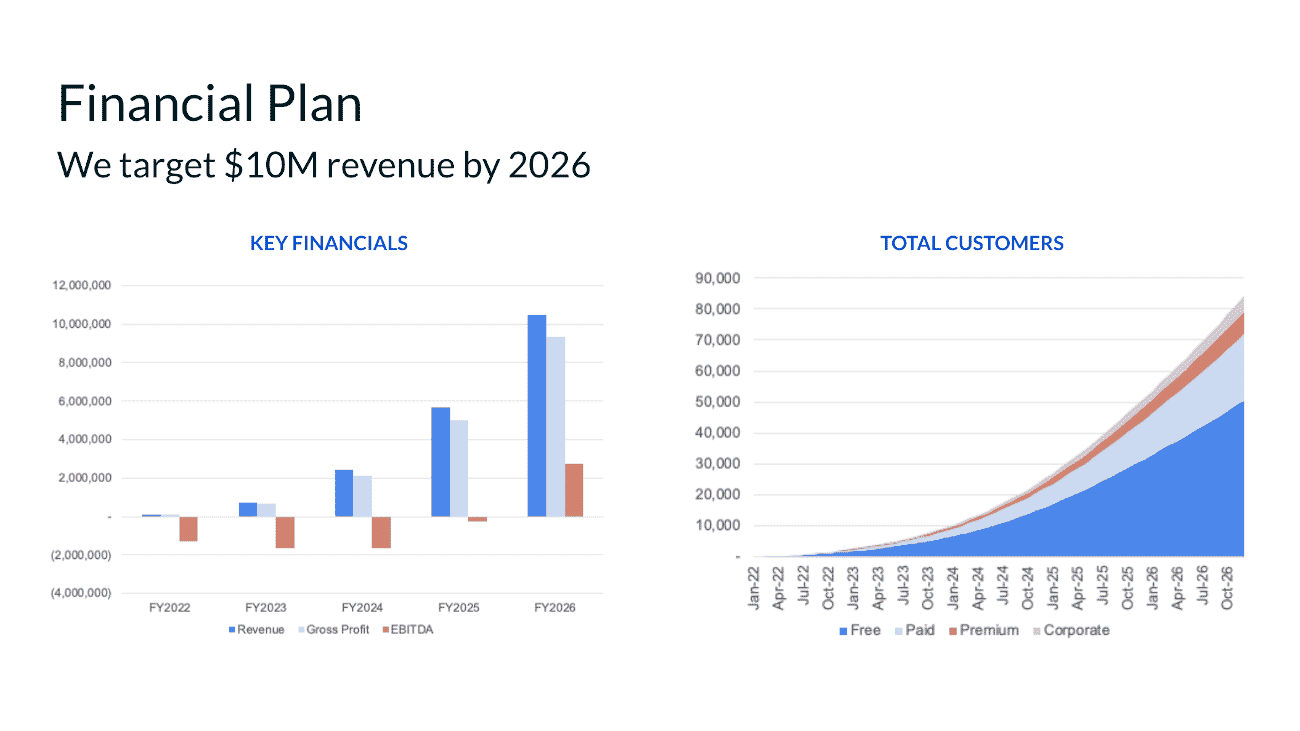

7. Where will your business be financially in 5 years?

As no one has a crystal ball that we know of (GPT-10 is that you?), it’s impossible to know how your startup financials are going to look in 5 years.

But it is possible to guess forward and plan.

Example financial projection slide in investor deck. [source]

Have you done 5 year financial projection forecasting?

If you haven’t done any formal projections I would highly encourage it. For nothing else than to visualize the potential you’re working with.

I have a great template if you need some inspiration. Reach me here.

More than a actual roadmap, your projections will act as your north star and guide you to certain decisions.

For this reason, it’s a given that an investor is going to want to see them.

🟢 - You have made transparent and data-driven assumptions with clear paths to increased revenue.

🟠 - You have made some assumptions but they need to be validated.

🔴 - You have shown overly optimistic or unfounded assumptions with no real path to increased revenue.

What is your business’ unit economics?

It’s important to understand the direct revenues and costs associated with your business model.

For investors, this usually means the direct cost of acquiring a customer, what that customer adds to the business in terms of revenue and what the lifetime value of that customer is.

When you earn more than it costs you to acquire those earnings, it’s good news.

🟢 - You have strong margins and understand your costs well.

🟠 - You understand your economics well, but they need some work.

🔴 - Your business has negative unit economics with no path to improvement.

8. What is your exit plan?

It’s very rare that founders go into business without considering how the fairytale ends.

Even if you don’t plan to exit, it’s good to consider one. It’s a fixed beacon that you and your team can row towards together.

Example exit plan slide from investor deck. [source]

What is your exit strategy?

Make no mistakes. For an investor, there is no entry without the exit.

They got into investing because they are in the game of getting out. It’s how they make their money and something they will want to understand very early on.

🟢 - You have a clearly defined and achievable exit strategy.

🟠 - Your plans are unclear but there are possible exit paths visible.

🔴 - Your plans are either non-existent, vague or unrealistic.

What is the expected return on investment?

This is the main answer that every investor will want to know.

It’s also an important one for any founder to consider.

What is the pontential return on your years of sweat equity?

What is the investor’s return on providing you fuel for the fire?

🟢 - Your business shows a clear and attractive return on investment potential.

🟠 - The how much and when is uncertain and needs more analysis.

🔴 - It’s uncertain how your business can provide a ROI.

Recap

Much of the above might not seem relevant to your current business stage.

It might also seem like a ‘cross that bridge when we get to it’ situation.

However, understanding and forming answers to these questions will help align yourself with the thinking and perspectives of those in the business of evaluating good businesses.

Even if you never raise a dollar of venture capital, knowing that you were able to tick off mostly positive responses is going to give you confidence that you’re on the right track.

Conversely, if you found yourself with some orange or red answers, this is a great opportunity to evaluate those areas of your business.

Best case; keep going!

Worst case; keep going!

That’s it for today! 🎉

If you got all the way to the end, I appreciate your time a great deal, and I hope I was able to provide some value.

If this was your first time reading Growth Receipts, please join for more startup growth strategies, frameworks, and systems. Or tell someone who can benefit.